Carbon Disclosure Effect, Corporate Fundamentals, and Net-zero Emission Target: Evidence from China

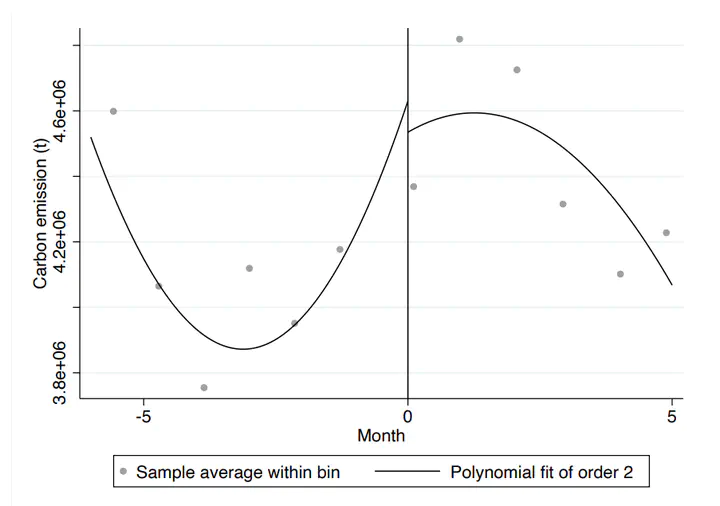

This paper conducts an empirical analysis of the impact of China’s national and regional Emissions Trading Scheme (ETS) on the financial performance of listed companies. A comprehensive dataset is constructed, encompassing firm-level carbon allowance data and firm-level emission data from July 2021 to December 2022. Our findings indicate that, in the initial years of China’s ETS implementation, companies participating in the national ETS experienced a statistically significant superior performance compared to non-participating firms due to excess free carbon emission allowances. Results also show that National ETS resulted in a statistically significant reduction in emissions of regulated companies. Nevertheless, involvement in the regional ETS yielded no discernible e↵ect on the financial and environmental performance of regulated entities. The outcomes reveal the existence of a substantial and statistically significant ”over-allocation of carbon allowances,” predominantly attributable to increased non-operational income of regulated companies in China’s national ETS.